Is ADA Compliance Mandatory for Websites?

In today's digital age, ensuring accessibility for all is not only a moral responsibility but also a legal obligation. The Americans with...

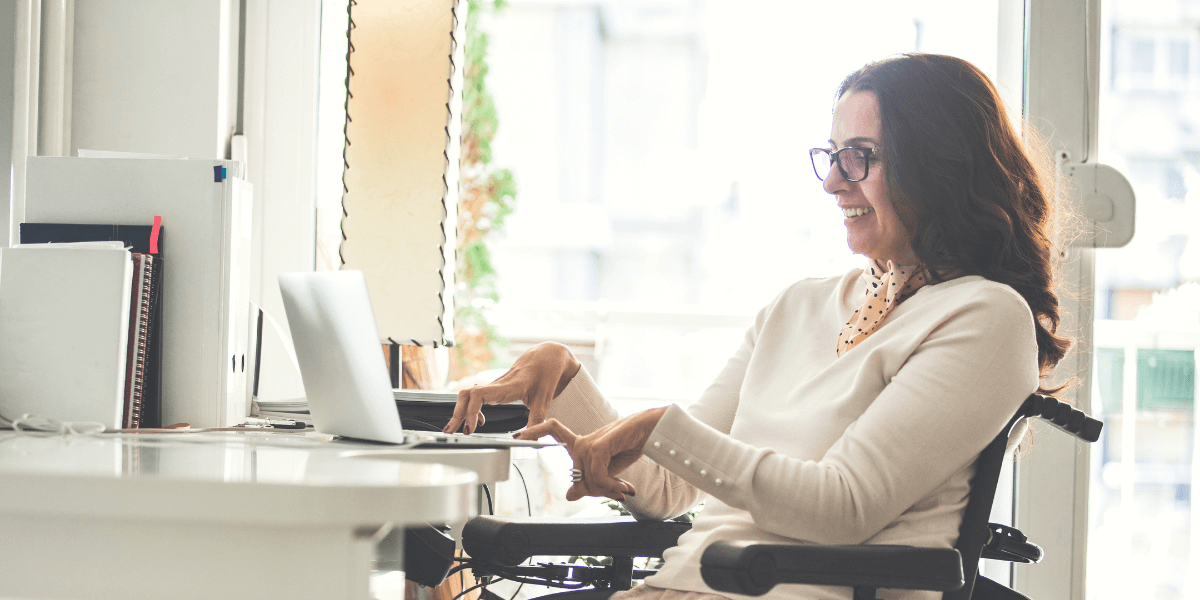

Ensuring that everyone, regardless of their abilities, can access and navigate your online presence is not just good practice, it's a legal requirement. But did you know that making your website ADA compliant can also lead to valuable tax benefits? Yes, you read that right!

In this beginner's guide, we'll breakdown the world of ADA tax benefits and provide you with essential insights on who qualifies, how to apply, and most importantly, how to make your website accessible. So, whether you're a business owner, a web developer, or simply someone interested in promoting inclusivity, let's discover how ADA compliance can open doors to both accessibility and financial incentives.

Take the first step towards ADA compliance by leveraging our free ADA compliance audit for your website.

The Americans with Disabilities Act (ADA) tax credit is an incentive designed to promote inclusivity and accessibility for individuals with disabilities. It rewards businesses and organizations that make their digital platforms ADA compliant. Here's what you need to know:

Before we discuss the tax benefits, let's clarify what ADA compliance means. ADA compliance refers to ensuring that your website is accessible to individuals with disabilities.

The Web Content Accessibility Guidelines (WCAG), which breakdowns how accessible and inclusive websites should look and operate for people with disabilities, states that your digital content must be perceivable, operable, understandable, and robust. It's all about creating an inclusive online environment where everyone can navigate and interact with ease.

The ADA tax credit is a financial incentive that encourages businesses and organizations to invest in accessibility. By complying with ADA guidelines and leveraging tools like a VPAT to guide your improvements, you can claim a tax credit to offset some of the expenses associated with making your website accessible. This not only promotes inclusion but also provides a valuable financial incentive for your efforts.

Now that you understand what the ADA tax credit is, let's explore who is eligible to reap these rewards.

To qualify for the ADA tax credit, your website must meet certain criteria:

Meeting these criteria is essential to claim the tax credit successfully.

Now that you know if you're eligible, it's time to learn how to apply for the ADA tax credit.

Before diving into the application process, it's advisable to consult with tax professionals or accountants, like our friends at Mire Group, who are well-versed in ADA tax credits. They can provide personalized guidance and ensure you're on the right track.

To support your claim, you'll need to gather documentation that verifies your ADA compliance efforts and related expenses. This may include invoices, receipts, and records of accessibility improvements made to your website.

The next step is to complete IRS Form 8826, which is specifically designed for claiming the ADA tax credit. Ensure that you fill out the form accurately, including details about your expenses and compliance efforts.

When filing your taxes, include Form 8826 and any supporting documentation. Be sure to follow the IRS guidelines and deadlines for filing your tax return.

Now that you're on the path to claiming ADA tax benefits, it's crucial to make your website ADA compliant. Here are some steps to get you started:

Start by conducting a comprehensive accessibility audit of your website to evaluate its accessibility. Identify any areas that require improvement and prioritize the necessary fixes.

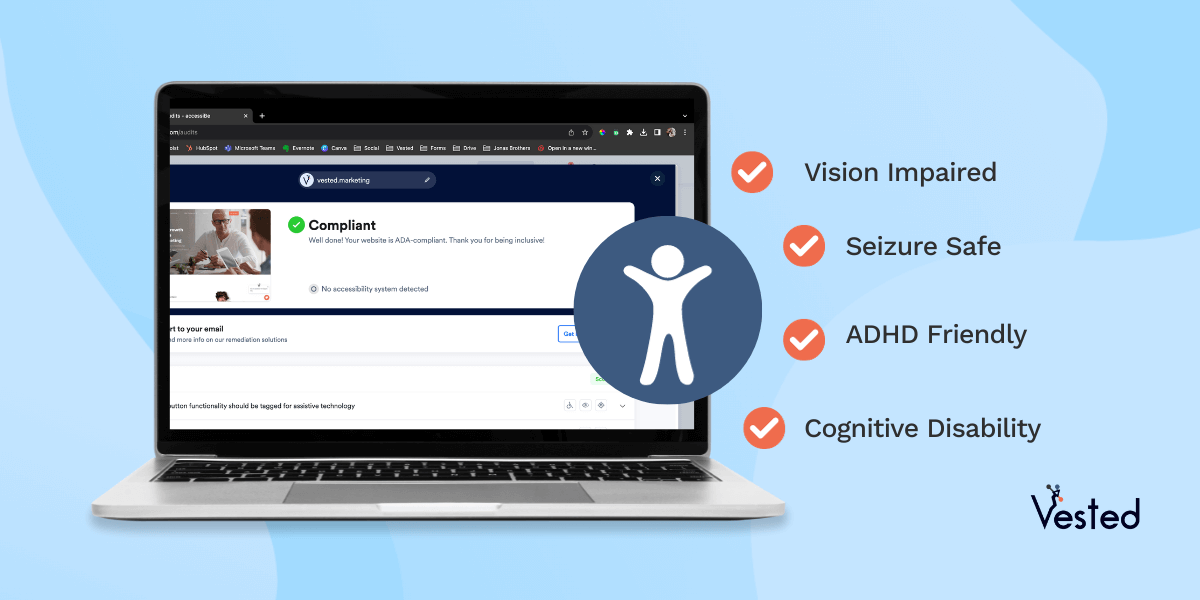

Consider partnering with accessibility experts, like us at Vested! We have partnered with accessiBe to make compliance that much easier! AccessiBe is a leading platform that offers AI-driven solutions for website accessibility. Their technology can help automate processes, saving you time and effort.

Based on the audit results, start implementing the necessary changes to your website. This may include adding alternative text for images, improving keyboard navigation, and ensuring compatibility with screen readers. By making these changes, you can reap other benefits, such as increased traffic with improved SEO.

Ensuring the ongoing accessibility of your website is crucial. It's important to regularly monitor and update your site to ensure that it continues to comply with ADA guidelines. By doing so, you can maintain an inclusive online environment for all users, regardless of their abilities.

The ADA tax credit provides a win-win situation for website owners. Not only does it promote inclusivity and accessibility, but it also offers financial incentives for compliance efforts. Industries spanning from engineering and fabrication to manufacturing and automation, as well as healthcare services like ketamine therapy and IV therapy, can all experience significant benefits from having an ADA compliant website.

If you're eligible, follow the application process diligently, and partner with us at Vested to make your website compliant! By doing so, you'll not only enhance the user experience but also unlock valuable tax benefits.

Remember, accessibility is not just a legal requirement; it's a moral imperative that benefits everyone. Contact us today to start your journey towards ADA compliance!

![]() As a certified HubSpot Partner Agency, we not only understand the benefits of using the inbound marketing platform to increase traffic and engagement, improve SEO, generate leads, design effective websites and boost sales, we know how to make it happen.

As a certified HubSpot Partner Agency, we not only understand the benefits of using the inbound marketing platform to increase traffic and engagement, improve SEO, generate leads, design effective websites and boost sales, we know how to make it happen.

We are inbound marketing experts, SEO gurus and top-notch website developers.

Our team of Engineers Turned Marketers can help get you noticed - for a more innovative and effective way to reach customers, or provide a more seamless way for companies to find your services. Inbound Marketing has no limit to industry, serving from Crypto & NFT, mining, oil and gas, technology & automation, engineering, technology, construction, healthcare, to industrial & manufacturing.

In today's digital age, ensuring accessibility for all is not only a moral responsibility but also a legal obligation. The Americans with...

Is your website accessible and inclusive? How can you tell? Making sure your website is accessible for those with a disability is not only required...

The CDC estimates that 1 in 4 adults in the United States (or 20% of the world's population) has a disability, which involves many people having to...